President Trump sees our large trade deficit, particularly as measured by goods and not including services (which we also export) as a sign of weakness. He’s actually kind of right, but not for the reasons he thinks. As a result he has imposed tariffs on our allies and enemies and everyone in between this past week, labeling the day he implemented this erroneous and harmful policy “Liberation Day.”

( link )

Wow – you have to watch that video. It’s very well done. Trump doesn’t know much about economics, but he sure knows how to make a video. This is something those of us who don’t understand his allure fail to adequately appreciate.

OK - let me state my position before I get into the details (the BLUF as the military likes to say – bottom line up front):

1) A trade deficit is economically neutral in and of itself. It can be a sign of a healthy or dysfunctional economy. (long)

2) The US trade deficit is the result of sustained government deficits (federal and state), that is to say, a dysfunctional government leading to a dysfunctional economy. (long)

3) Trump’s tariffs will raise prices paid by American’s and raise interest rates. (short)

4) Trump’s tariffs will not fix the underlying problem of government spending. (short)

Let me address these four points. Feel free to skip points to the conclusion.

Point 1: A trade deficit is economically neutral in and of itself. It can be a sign of a healthy or dysfunctional economy.

This is what international trade looks like:

When we buy things from a foreign country, we receive imports of things (or services) and we give them dollars (I am writing from America – feel free to insert your own currency if you are reading in a different country).

Let’s say I buy a Ferrari Roma for a mere $247,308 (that’s the bottom line model) – and it is imported from Italy.

I (effectively) send $247,308 to corporate headquarters in Maranello. Italy is part of the European Union and uses euros, not dollars. The company cannot spend dollars in the EU. If you go down to the local café, they want you to pay in euros. Where can you spend dollars? Well, you can spend them where they came from: the US. (let’s be clear – Ferrari can convert the US dollars into euros through a bank, and there are lots of people who are happy to take US dollars, but eventually those dollars have to find their way back to the US. The bank just gives them to people who want to buy something in America.) If Ferrari is going to buy something American, it can buy two broad types of assets from the US with its US dollars: 1) US goods (physical stuff like steel, chemicals, plastics, electronics, etc.), or it can buy 2) financial assets (like US Treasury Bonds, debt or equity of US companies, real estate, etc.).

A trade deficit is the result of a simple formula:

Exports – Imports = Net Exports

When Net Exports are positive, we have a trade surplus; when Net Exports are negative, we have a trade deficit.

A trade surplus is when Net Exports is positive, or when Exports are greater than Imports (e.g., 100 E – 50 I = 50 trade surplus).

A trade deficit results when Net Exports is negative, or when Imports are greater than Exports (e.g., 50 E – 100 I = - 50 trade deficit).

When I buy my Ferrari (as if!), I increase the Imports of the US by $247,308, increasing the trade deficit between the US and Italy. If I sell a subscription to Flourishing for $50 to an Italian subscriber, I increase exports by $50. So let’s say I buy one Ferrari and sell one subscription to an Italian subscriber:

E $50 – I $247,308 = - $247,258. That’s a pretty big trade deficit. I have to sell a lot more subscriptions to cover my Ferrari! In the meantime, I worsen the trade deficit. So come on folks, sign up for a paying subscription! (just kidding. maybe. I do need a Ferrari.)

Now Ferrari has $247,308. The company could buy supplies and materials for production (goods) in the US, or it could buy US financial assets. Let’s assume it does not need any US goods for production, so the Ferrari CFO decides to buy US corporate bonds. There is an opposite account, called the capital account, that captures the balance of flows of capital between the US and Itay.

If Ferrari buys $247,308 of US corporate bonds, and I buy $50 worth of Ferrari stock, the US has a net capital surplus of $247,258 (the exact opposite of the trade deficit).

Inflow $247,308 – outflow $50 = surplus of $247,258

So the US has a trade deficit of $247,258 and a capital surplus of $247,258.

By definition, the trade and capital accounts have to be equal. This is called a balance of payments (BOP). If we have a very big trade deficit, we also have a very big capital surplus of the exact same amount.

Net Trade flows = Net Capital flows

When is a trade deficit (which implies a capital surplus) a good thing? Isn’t it bad if we buy more stuff from other countries than they buy from us? (If you say yes, then you are espousing mercantilism, a debunked economic theory popular in the 17th-19th centuries in Europe. In other words, economists don’t think that anymore. You’re a couple hundred years out of date. Still wearing a powdered wig and a ruffled collar to all your dates? we might need to talk…) The answer is it depends. It’s a good thing when we use the foreign capital for investment. In the Ferrari example, Ferrari buys corporate bonds. Corporate bonds are (simplifying) loans to companies. Presumably companies sell corporate bonds when they want to make big investments, like building factories. Hospitals (including non-profit hospitals) use corporate bonds to fund the building of new hospitals, clinics, and so forth. If we can get a foreign country to give us money to build productive resources in the US, that’s a pretty good deal. Especially since we get to have them invest in our country and get to buy their stuff. I.e., I get to buy a Ferrari and then Ferrari helps fund my local hospital building a new wing. That’s a good deal! (Mr. Trump – pay attention! An actual good deal!) When capital is put to productive uses, it creates new jobs and more income in the country that it is invested in, regardless of where the money came from. Some of that income goes back to the foreign country in the form of interest payments, but if the capital was invested well, the net value created in the local country will exceed the amount of interest sent out.

When is a trade deficit (which implies a capital surplus) a bad thing? I really hinges more on what you do with the capital that you get. We attract the foreign capital by buying foreign goods. But what if we take a loan from the foreign company and use it to buy a Disney vacation? Or use the loan to go to the bar and buy all our friends drinks? There is nothing wrong with a Disney vacation or buying rounds of drinks for your friends if you can pay for it. Vacations and parties are forms of consumption, not investment. Once you consume your vacation or your shots, there is nothing left. Unlike when we use the foreign capital to fund a new factory or hospital, when we consume the capital there is nothing left to produce more income.

Point 2: The US trade deficit is the result of sustained government deficits (federal and state), that is to say, a dysfunctional government leading to a dysfunctional economy.

( link to graph. Net exports is simple Exports – Imports)

The US is in the second category. We have a large trade deficit and large capital surplus largely because we have to borrow a lot of money to fund our federal debt. We started running big Federal budget deficits in the 60’s and haven’t looked back. Obama ran a very large deficit, then Trump (version 1) ran an even bigger one, and then Biden said, hold my beer. Trump (version 2) is likely to run a very large one as well, despite the performative DOGE’ing he’s doing, because the main expenditures of the Federal government are Social Security, Medicare and Medicaid, the Department of Defense, and interest on the Federal debt, in that order. More on that next week. The problem is we are mostly borrowing money each year to cover spending on consumption (that’s the Social Security, Medicare and Medicaid, and a chunk of DOD), not investment. When the government builds roads and bridges, that is investment. When the government sends your grandmother a Social Security check, it is funding consumption. (Technically it’s a transfer, but when grandma spends it on bingo, a pack of Marlboros, and fifth of Jack Daniels, let’s be real, it’s consumption. OK, maybe that’s just my grandma. Maybe yours spends it on yoga classes and kale salads, but that’s still consumption. Nothing is left to enhance production.)

The US has a negative net export account and a negative trade balance not because it is making huge investments in infrastructure, but because it is funding consumption with debt.

If Trump wants to fix the trade balance, he needs to raise taxes or cut spending. And since the main things the Federal government spends money on is pensions and healthcare, that’s what needs to be cut or taxes need to be raised. All the DOGE’ing isn’t going to eliminate the deficit or bring down the overall debt (which now brings with it a massive amount of interest due).

So that’s why the US trade deficit is a problem. It’s not because foreign countries tariff us. It’s mostly because the Federal government spends more money than it raises, and we have to go out to the world to ask to float us a fiver (actually it’s 35, as in $35 Trillion).

Point 3: Trump’s tariffs will raise prices paid by American’s and raise interest rates.

I already wrote a long post about why tariffs raise prices and make the country that imposes the tariff worse off by raising prices (see https://markbonica.substack.com/p/tariffs-hurt-domestic-consumers ).

Why will the tariffs (likely) raise interest rates? It’s pretty simple. We’re sitting here in the US, spending more money than we take in. The government needs to borrow money from someone. Right now, the government can borrow money from US citizens or foreigners. US citizens already hold dollars, so they can lend dollars to the government. Foreigners hold their own currencies. They only have dollars if they sell goods to Americans. If we make it harder for them to sell goods to Americans, they will hold fewer dollars, with which they can either buy American goods, or lend Americans, including the government, dollars. Tariffs will shrink the supply of dollars available to borrow. When there are fewer dollars available to borrow, but the same number of people looking to borrow the same amount of money, interest rates go up.

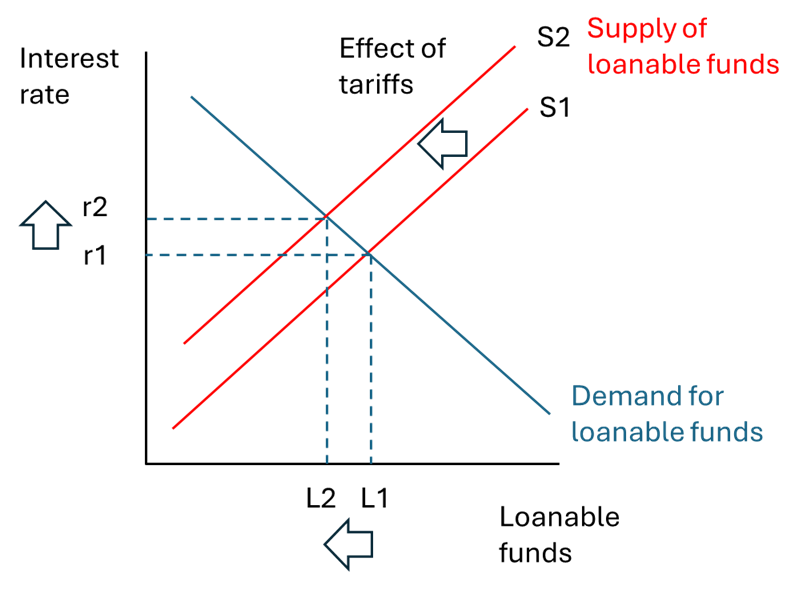

Using supply and demand, we have an initial equilibrium with an initial supply S1 of loanable funds (dollars), and a demand for dollars, that generates the initial amount of loanable funds at a rate r1. When tariffs go into effect, and foreigners have fewer dollars they are looking to do something with, the supply of dollars that could be loaned shrinks, causing the supply of loanable funds curve to shift left to S2.

The result of the left shift, which represents fewer loanable dollars because fewer foreigners now hold dollars, the result is fewer loans and higher interest rates.

Right now foreigners hold large amounts of US debt because they sell us a lot of stuff. If they no longer sell us stuff, they won’t be interested in buying as much US debt. The result is the US government, as well as US consumers, will have to compete for fewer dollars to borrow, and will have to pay more interest to get access to the dollars that are still available.

It’s bad, all the way around.

Point 4: Trump’s tariffs will not fix the underlying problem of government spending.

I’m going to review the FY2024 Federal Budget next time. I like to talk about this every now and then, and it seems like now is a good time. As I noted above in Point 2, the thing that drives the trade deficit is excessive government spending without adequate taxes.

As I noted above, the problem the US government faces is an imbalance between the tax revenue it takes in and the amount that it spends. The deficit, that is the shortfall of revenues relative to outlays, was $1.9 trillion. That’s an insane amount of money. That is more than what the Federal government spent in 2001. Most of the federal budget is spent on Social Security, Medicare, and Medicaid. Even if you cut the entire Department of Defense, you wouldn’t balance the Federal budget.

Tariffs will generate a small amount of new income for the Federal government, but they will have large negative effects on the economy, reducing the income earned that forms most of the taxes that the Federal government operates on. Given how large the deficit is, I am doubtful that the new revenue from taxes will meaningfully reduce the deficit.

More on the deficit next time.

Conclusion:

The trade deficit in the US is bad because it is the result of government dysfunction. Tariffs will hurt us by raising prices and interest rates.

Governments exist to serve the people by providing an environment where people can pursue their happiness and flourish. Our government is failing to do this primary function.