Most of the courses I teach are difficult topics: finance, accounting, economics. People generally come into the courses worried about the math. The math is actually mostly not that difficult. You can do most of my courses with nothing more than eighth grade math. The hard part of my courses is not the math - it is understanding what the math represents. I like to say that these courses have more in common with a foreign language than they do with a math course. I try to inject some humor into my courses to help people relax. I do a lot of silly things (“statistics hands” as one of my former students named my demonstration of correlation and inverse correlation) and try to lighten things up so students can get over their math anxiety. Sometimes I make people laugh unintentionally. It’s a little more of laughing at, rather than laughing with. But I’m a good sport - if it helps students learn, I’m willing to be laughed at.

I have taught the finance sequence for the UNH Physician Leadership Development Program for several years. This past Wednesday I taught the last part of this year’s finance sequence. The topic was break even analysis and budgeting. And I made the physicians laugh (at me) twice during this class. The first time I got a good belly laugh was when I started using the document projector and hand writing notes with a sharpie. I jotted down “mgrl acct’g” (managerial accounting) at the top of the sheet of paper as I was introducing our subject and one of them said, “Wait - what does that say?” And I said, “Oh, managerial accounting”. And they all started laughing because, even setting aside the abbreviation, my handwriting was such a mess. So that was a new low for me - having a group of physicians laugh at my handwriting. The second time they laughed was when I said that “budgeting was cool”. They all laughed, practically slapping their knees, then realized I was serious, then they laughed some more. But budgeting is cool, and I want to tell you why.

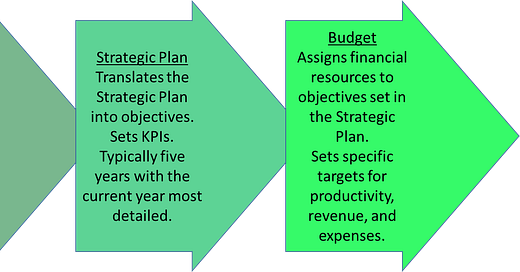

This is the graphic1 I use to introduce the topic of organizational budgeting. Budgeting is the operationalization of higher level organizational planning. At the highest level, the organization has a series of statements about itself - mission, vision, and values. These statements clarify the organization’s purpose, who it exists to serve, and how it will work. The strategic plan is a high level set of goals and objectives that begin to operationalize the strategic statements. They are high-level and provide the left and right limits for the management team, and the high-level measures that the board of directors will use to evaluate the organization’s success in meeting the organization's purpose as defined by the organization’s strategic statements. Strategic KPIs might include basic financial measures like revenue growth targets and return on equity. They might also include growth in particular areas of the organization’s serviced population as well as quality outcomes. The strategic KPIs support the strategic objectives, which support the organizations’ strategic statements. If budgeting is done well, the budgets support the strategic KPIs. Each sub-unit’s budget should reflect how the subordinate operating unit supports the strategy because the budget provides resources to the operating unit to carry out the strategy. When this process is done well, everything nests together. Managers of subordinate units should have to explain how their budget requests meet the organization’s strategic KPIs, which ultimately support the organization’s strategic statements. The whole system is nested like a Russian doll when done properly.

What I enjoyed about the budgeting process was helping operating unit managers understand the strategic KPIs and helping them see how to shape their budget to meet those goals. The budget represented the allocation of the organization’s resources. I also enjoyed working with senior management to determine which operating units were the most important for the current strategic effort and therefore should receive additional resources, and which we could afford to shift resources from. This wasn’t always a fun discussion because no one wants to lose resources and everyone thinks they are already under-resourced. But when the process is done well, the budget supports the organization’s strategic accomplishment.

Sometimes the process doesn’t work that well. When it didn’t, it was usually because powerful operating managers were able to cajole or keep resources that should have been allocated elsewhere. In these cases, there was a disconnect between the the levels of the strategic allocation process. Sometimes the strategic statements were just words on the wall, and there was no connection between the statements and the strategic plan and the whole process was ultimately ad hoc, and the budget was primarily based on what was done in prior years. When the strategic statements were just a lot of blah blah blah like this,

Then the process was usually personality driven and not strategically disciplined.

When I talk to groups of physicians, or really any group of smart people who are dedicated to their organization’s success, I find their frustration with the budgeting process is because they don’t see the connection between the levels of stragetic resourcing. A good financial manager can communicate the linkages from the organization’s purpose to the strategic plan to the budget such that the individuals in the work unit understand why they have the resources they have. When everyone has that level of understanding, they may not be happy, but they don’t feel like they are being treated unfairly. And that is why budgeting is cool. A well-constructed budget is a tool for bringing the mission of the organization into reality.

Stepping back from organizations, we can think of our lives as being constructed in a strategic process. The way we spend our time and our resources is the actualization of our being in the world. If we don’t take time think about what is important, what our purpose is, and then express our purpose as longer term goals, then what we do day-to-day won’t necessarily support any larger purpose. Time will pass whether our lives are purpose-driven or not. If they are not purpose driven, then we will be puzzled by the outcome. We will come to the end and realize, this isn’t the life I wanted. But what was the life you wanted? Did you develop a statement of strategic purpose? Did you develop long-term goals? Did you evaluate what you were doing on a day-to-day basis and determine if what you were doing was supporting your personal KPIs? With our lives, time is the primary resource we budget. Money matters, but time is the first driver of everything. While doing this in your personal life isn’t exactly the same, it does have the same structure.

A budget for life. Cool, am I right?

**

Thanks for reading! Let me know what you think! Please share if you think this is useful.

Adapted from Gapenski's Healthcare Finance: An Introduction to Accounting and Financial Management, Sixth Edition