Greetings from the University of New Hampshire! Spring break ends tomorrow and I haven’t quite caught up with all my grading. Uggh. I will have a busy day tomorrow - probably like many of my students.

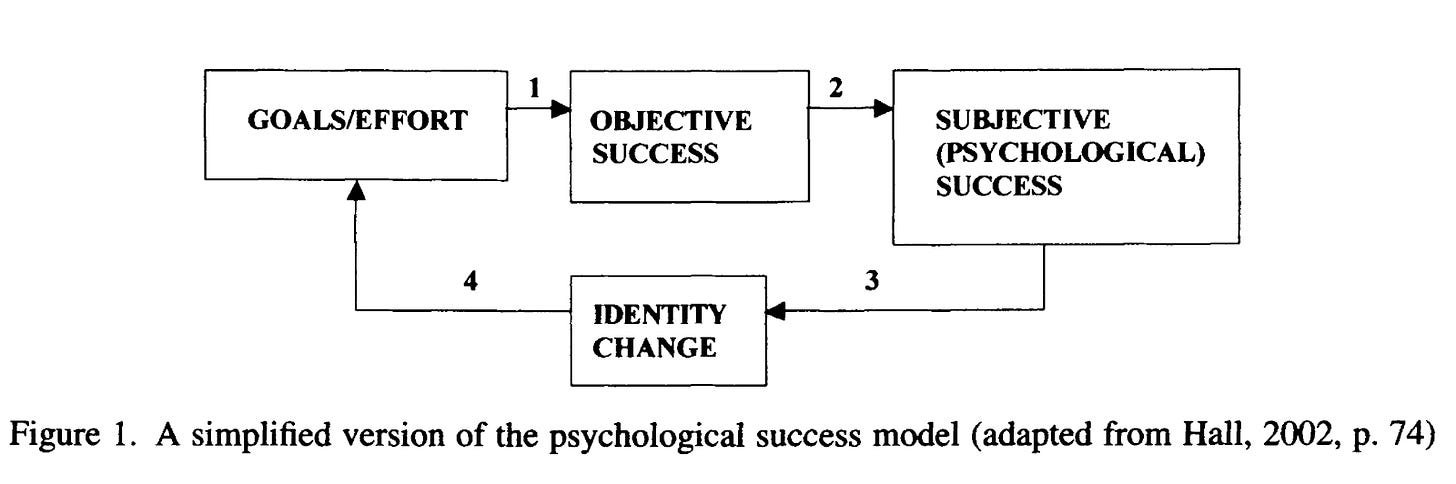

Last week I used my own professional career as a process of finding the right fit in order to be the person you are meant to be. This week I’ve been working on a new research project and one of the articles I reviewed, Psychological Success: When the Career Is a Calling by Douglas T. Hall and Dawn E. Chandler included the following model:

The gist of this model goes like this: we begin a process of career exploration, putting forth effort to find work that aligns with our needs and values. When this goes well, we experience objective success - we can see we are good at something, and that is also often accompanied by external validations such as promotions, raises, and praise. This can lead to subjective success, where we feel validated in our choices and accomplishments. This then leads to our revising our identity - internalizing the successes and gaining confidence in our new-found competence. I often ask physicians, for example, when they internalized their identity as a physician. The response is variable, but the vast majority of them required some sort of external validation - patients demonstrating trust in the physician’s decision making is often one of the key external events that sets forth the identity change - internalizing “I am a doctor.” This identity change gives one more confidence, and combined with a sense of success, leads to more effort and the cycle repeats itself.

Hall is famous for popularizing the concept of the “Protean Career”, often referred to as “the career with heart”. The Protean Career assumes the world is constantly changing, and in order to be successful, we have to change with it. But the theory also emphasizes the importance of finding work that is subjectively meaningful (that’s the “heart” part). The fact that we have to constantly adapt is why the success model is a cycle. Through iteration after iteration of the cycle, we find what we are good at and what we enjoy, developing confidence in our abilities while sorting out how to be true to ourselves.

As I described last week, the first years of my career were not a roaring success. Not terrible - I never got fired - but not satisfying. Thanks to the Army I was able to try a lot of things, and some things I was good at and some things I was not. The thing I found I was good at was understanding finance, and with modest success I put more effort into it and eventually was given the chance to do it full time and it worked out. I internalized those successes, and began thinking of myself as a “finance guy”. But even as I was becoming a finance guy, I was drawn to opportunities to teach. I joined a journal club at one duty assignment, then started journal clubs at my next two assignments. I realized there was a lack of training on analytical skills available to people in my organizations, so I started teaching classes on how to use Excel and Access. When I applied to go to PHD studies so I could become a professor in the Army-Baylor program, my boss (who was a graduate of the program) took me aside and asked me if I was sure I wanted to do that because it would cut me off from future promotions. When I told him I understood that and was willing to make that sacrifice (of objective/external success), he nodded and said something to the effect of, “I think this is your calling - I just wanted to be sure you understood the costs.” I went through many cycles of learning and I continue to do so.

I think if you are lucky, you stumble early on into a career that gives you both objective and subjective success. More likely, it will take many iterations of exploration and effort to find where you belong. Along the way the world will change (there was one personal computer in the clinic I worked in for my first job) and opportunities will change, and you will have to change with it, so the iterations of exploration never really end.

I hope Hall’s model is useful to you either for yourself or when you mentor younger folks.

Now on to the links!

(Image is of the Lavender Lady on Goat Island from earlier this week.)

**

Read

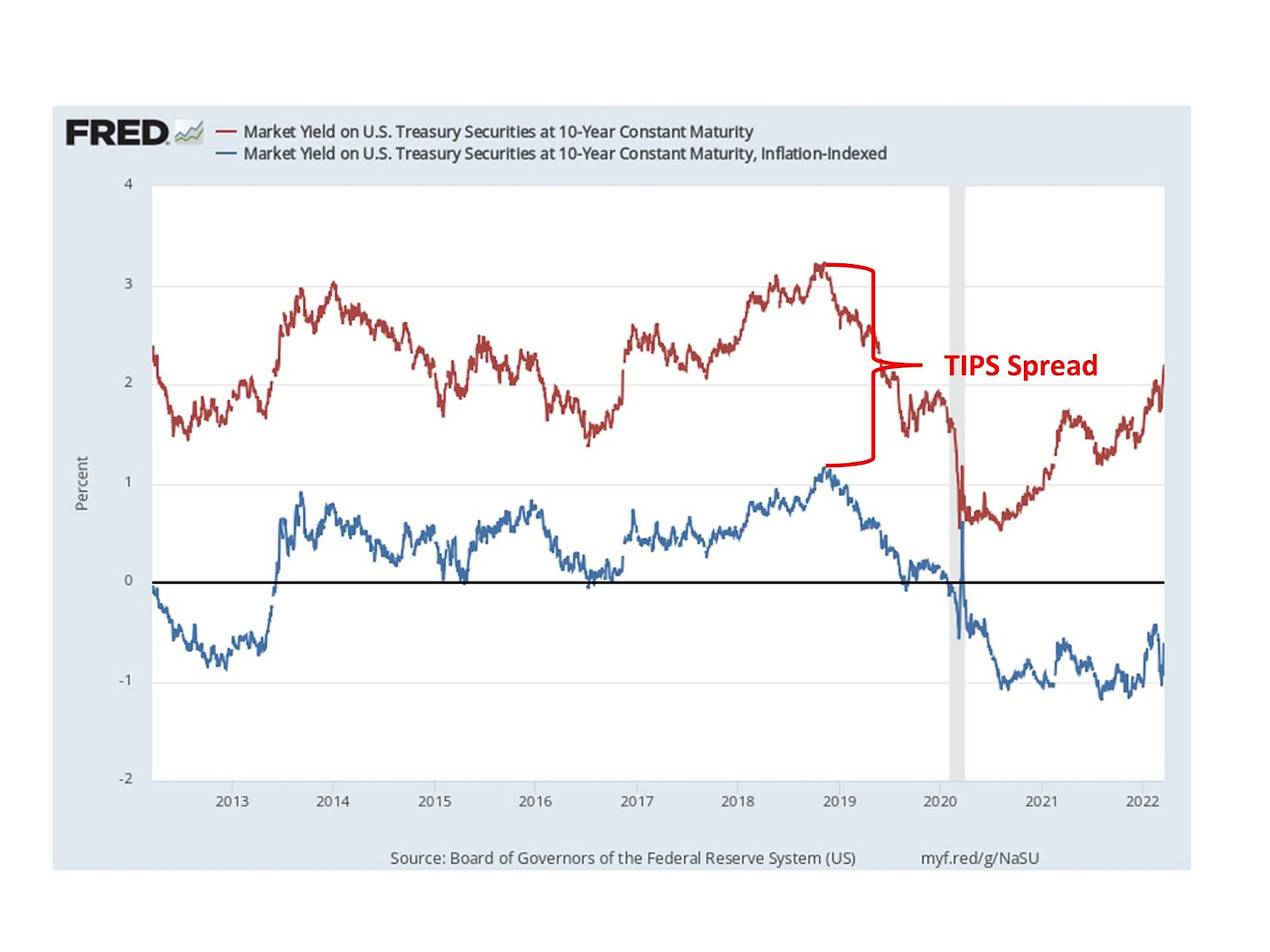

What: TIPS Spread

https://fred.stlouisfed.org/graph/?g=NaT5

Why: US government debt - sold as Treasury Bonds to fund our federal budget deficits - are regarded by the world as a “risk free” asset - meaning there is no chance of losing money from the investment through default. In reality there is no such thing as a “risk free” asset, but T-Bonds are about as good as you can get.

With a regular 10 year T-Bond, you pay for the bond and for the duration of the bond’s life you receive semi-annual “coupon” payments and at maturity you receive the face value of the bond back. So if you bought a bond with a $1000 face value bond, with a 6% coupon rate, you would receive $30 every six months (6% x $1000 divided into two payments of $30 each), and at maturity you would receive $1000.

Without getting into a full lecture on bond valuation, let’s just think about that $1000 that, with a 10-year bond, you would be getting 10 years from now. That’s a long time, and with inflation, that $1000 isn’t going to buy what it would have if you had kept it in your pocket. Let’s say inflation is 3% per year for 10 years. The purchasing power of your $1000 in 2032 would actually be about $744. So even though you are absolutely going to get the $1000, it isn’t going to be worth $1000 in purchasing power. Because investors know this, they balance the loss of purchasing power on the face value of the bond with demanding a higher coupon rate over the life of the bond.

But what if we could account for inflation directly? Enter the Inflation-Protected Treasury Security (TIPS). With a TIPS bond, the face value of the bond increases each year by the amount inflation is recorded at. So if inflation is 3% during the first year, the face value is increased from $1000 to $1030. Over the course of 10 years, if inflation was 3% per year, the face value payment you would receive at the end would be about $1344. Because investors know that they will not lose purchasing power on their face value payment, they are willing to accept a lower coupon rate - they adjust their coupon rate down by the amount they think inflation will be.

So with all that said, the graph above shows the difference in coupon rates between the regular 10-year T-Bond and the TIPS 10-year T-Bond. The difference between the rates is called the TIPS Spread and it tells us what investors think inflation will be over the next 10 years. What’s important about this spread is that the only way you get to influence this spread is by buying or selling these bonds. So there is real money on the line here, real skin in the game, not just some talking head (or someone writing a newsletter).

As of Friday, the TIPS spread was 2.93%. It has increased steadily but not dramatically, so this tells me investors are still projecting inflation will be transitory - i.e., it will settle back down and return to the historical average. I will be watching the TIPS spread myself for hints about the future. You can watch it too by clicking on the link above.

**

What: Bernie Sanders’ economic ignorance

Why: A lot of Leftist/Progressive politicians are arguing that inflation is the result of corporate greed. This is an ignorant statement. Corporations exist to generate profit for their investors. Full stop. The prime directive of corporate employees is to find ways to make profits. You can call that greed if you’d like, in which case discovering corporate greed is like discovering water flows down hill. Congratulations. The question is why is inflation happening now? Senator Sanders has been pronouncing on corporate greed his whole life as a professional socialist, yet inflation has been hovering around 2% for the last 30 years. Why are corporations suddenly able to indulge their greed now when they haven’t been able to for decades?

**

What: Arnold Kling, The Chess Game of Financial Regulation

https://arnoldkling.com/essays/papers/chess.html

Why: Unlike the above economic ignorance, Arnold Kling is one of my favorite economists to read. This is an older piece (going back to the 2009 financial crisis), but the underlying message is still relevant: incentives matter, and understanding economics is really all about understanding the structure of incentives. Politicians get to manipulate the structure of incentives in society, and so it is critical that they understand economics and explain it clearly to their constituents.

**

Watch

What: Conor Neill, How to do the most important work of your life. The 4 key ingredients. (7 min)

Why: Conor Neill is always insightful. In this short video he addresses the issue of subjective success that I talked about above in the intro. He has four quick principles that are worth reflecting on.

**

Listen

What: Health Leader Forge, Major General David Rubenstein, FACHE, US Army, Retired (130 min)

https://healthleaderforge.blogspot.com/2022/03/major-general-david-rubenstein-fache-us.html

Why: Very excited to share my latest interview. As I mentioned last week, I spoke with (retired) Major General David Rubenstein, one of the most respected Army Medical Department leaders I had the opportunity to serve under. We cover his remarkable military career, his advice to leaders at each level, what it takes to become a general officer, what it is like to lead at the general officer level, and what he has chosen to do since retirement. We close on one of my favorite topics - what it means to live a good life. I hope you enjoy this interview - it has a lot in it for both military and non-military alike.

Toward the end of the interview, MG Rubenstein mentions a print he is looking at. This is the print:

It is called, “These are my credentials” and you can read about it here: http://www.framingfox.com/thesricreev.html

Thanks for reading and see you next week! If you come across any interesting stories, won't you send them my way? I'd love to hear what you think of these suggestions, and I'd love to get suggestions from you. Feel free to drop me a line at mark.bonica@unh.edu , or you can tweet to me at @mbonica .

If you’re looking for a searchable archive, you can see my draft folder here: https://drive.google.com/drive/folders/1jwGLdjsb1WKtgH_2C-_3VvrYCtqLplFO?usp=sharing

Finally, if you find these links interesting, won’t you tell a friend? They can subscribe here: https://markbonica.substack.com/welcome

See you next week!

Mark

Mark J. Bonica, Ph.D., MBA, MS

Associate Professor

Department of Health Management and Policy

University of New Hampshire

(603) 862-0598

mark.bonica@unh.edu

Health Leader Forge Podcast:

http://healthleaderforge.org

“The meaning of life is to find your gift. The purpose of life is to give it away.” – Pablo Picaso